The 9 YieldMax Weekly Dividend ETFs: How to Build Compounding Income with Patience and Risk Management

YieldMax has rapidly become a standout in the world of income-focused ETFs by offering a suite of funds that pay dividends weekly, targeting investors seeking regular cash flow. As of May 2025, YieldMax offers nine ETFs with weekly distributions, each focused on different sectors or strategies. In this article, we’ll introduce each ETF, discuss their risks and potential rewards, and show how disciplined compounding and risk management can help you build a growing stream of income over time.

YieldMax’s 9 Weekly Dividend ETFs: Overview

How to Build Compounding Income: Time, Patience, and Risk Management

1. The Power of Compounding Shares

Building a meaningful weekly income stream from these ETFs requires a disciplined approach:

- Start with a Base Position: For example, holding 10 shares of each ETF.

- Reinvest Dividends or Add Shares Regularly: By purchasing (or reinvesting into) one additional share per month, you can steadily increase your income potential.

2. Simulated Growth Scenarios

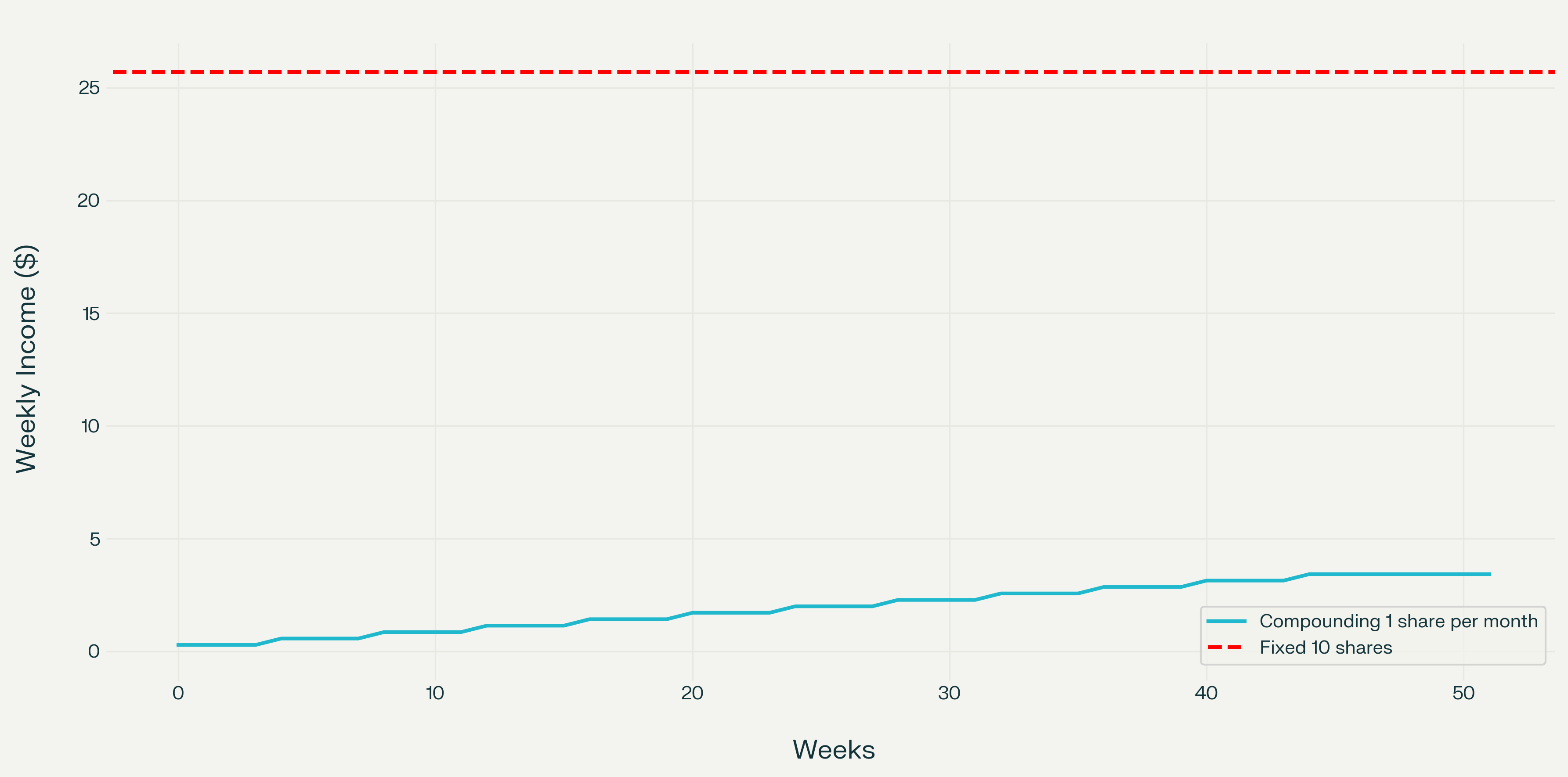

Simulated Weekly Income from YieldMax ETFs

The blue line shows the growth from compounding one share per month, starting from zero and reaching about $3.43/week by year-end.

The red dashed line shows the income from holding 10 shares of each ETF ($25.70/week).

Let’s see how your income could grow under two scenarios, using real-world dividend estimates:

Scenario 1: Fixed 10 Shares of Each ETF

- Estimated Weekly Income per ETF:

- CHPY: $3.60

- GPTY: $2.90

- LFGY: $4.70

- QDTY: $3.80

- RDTY: $4.00

- SDTY: $3.10

- ULTY: $0.90

- YMAG: $1.00

- YMAX: $1.70

- Total Weekly Income: $25.70

Scenario 2: Compounding 1 Share per Month

If you add one share per month (spread equally across all ETFs), your weekly income grows steadily over the year:

- Week 1: ~$0.29/week

- After 6 months: ~$1.43/week

- After 12 months: ~$3.43/week

Why Careful Calculation and Risk Management Matter

- Realistic Expectations: Options-based ETFs can offer high yields, but their strategies cap upside and expose you to full downside risk. Payouts can fluctuate, and principal loss is possible

- Diversification: Spreading investments across all nine ETFs helps reduce sector-specific risks.

- Patience: Compounding takes time. Incremental share additions, even small, can significantly boost your income over years.

- Risk Controls: Only invest amounts you can afford to lose, and regularly review your portfolio to ensure it matches your risk tolerance.

Conclusion + Bonus! Free Yieldmax Dividends Calculator

YieldMax’s weekly dividend ETFs offer a unique way to generate frequent income. By starting with a base position and steadily compounding your holdings, you can build a growing income stream. However, these ETFs are not risk-free—careful planning, patience, and ongoing risk management are essential for long-term success.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial, investment, or tax advice. The information provided is based on publicly available data as of May 2025 and may not reflect the latest changes. Always consult with a qualified financial advisor before making any investment decisions. Investing in ETFs involves risk, including possible loss of principal. Past performance is not indicative of future results.

Sources: YieldMax official ETF pages and simulated income calculations based on current dividend estimates and are subject to change.